OLYMPIA — Washington voters have rejected personal income tax-related measures at the statewide ballot several times over the past eight decades. Now voters in the state capital will decide whether to approve an income tax on the city’s highest earners, even as the legality of the measure remains in question.

Initiative 1 seeks a 1.5 percent tax on household income in excess of $200,000 for residents of Olympia, a city of about 50,000 people. The measure seeks to raise an estimated $3 million a year for a public college tuition fund that would give all Olympia public high school graduates and GED recipients tuition for at least the first year of community or technical college, or the equivalent amount — about $4,000 — for in-state public university tuition.

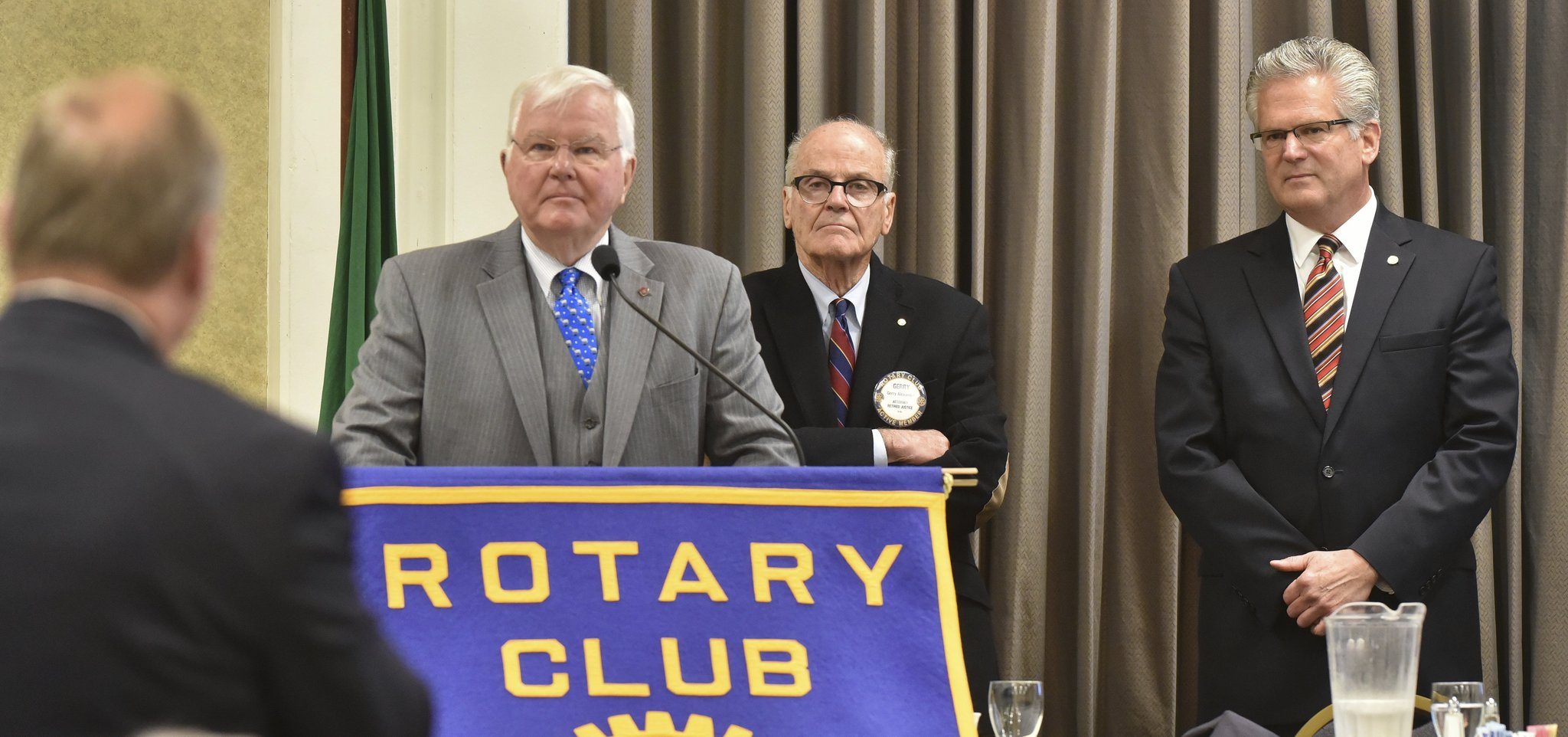

“It puts the spotlight on the finances of education,” said Democratic state Sen. Sam Hunt of Olympia, a supporter of the measure. “Obviously, it’s controversial.

“But I think at some point people need to step forward and say what we’re doing isn’t working and we need to find better solutions. And this is one step toward finding a better solution.”

Opponents of the measure argue that Seattle activists are focused solely on teeing up a test case for the state Supreme Court and using a tax on the residents of the city of Olympia to accomplish that goal.

The last time Washington voters approved an income tax was in 1932, but the measure was ruled unconstitutional by the state Supreme Court the following year.

In 1984, the state Legislature approved a law that that prohibits a county, city or city-county from levying a tax on net income.

“It’s not about education,” said Olympia Mayor Cheryl Selby, who noted that she supports the idea of a statewide income tax and has voted in favor of one before. “What I’m trusting is that our community, because we are so literate and educated around political issues, will see through this.”

Last month, the state Court of Appeals ruled that the Olympia income-tax measure should appear on the ballot even as legal challenges to it continue.

The ruling came following an appeal of an August ruling by Pierce County Superior Court Judge Jack Nevin, who found the measure went beyond the scope of local initiative power and ruled it should not appear on the ballot.

The appellate court order noted that there will be “ample time to litigate the issues raised after the election.”

The phrase “income tax” does not appear on the ballot title after a Superior Court judge ruled in favor of initiative proponents that it would be prejudicial to the proponents, who say the proposed tax is technically an excise tax because it taxes gross income.

Instead, the ballot title simply says that the measure “concerns establishing and funding a college grant program.”

In the fuller description below the title, it notes that the grants would be funded by a tax on household income above $200,000.

Supporters of the measure — including the Economic Opportunity Institute in Seattle — have raised more than $213,000, with the top donations coming from residents of Seattle and surrounding areas. Opponents have raised about $5,700.

Washington is one of seven states — Alaska, Florida, Nevada, South Dakota, Texas and Wyoming — without a personal income tax.

New Hampshire and Tennessee have a limited income tax on interest, dividends and capital gains, but they do not tax wages and salaries, according to the National Conference of State Legislatures.

Voters last weighed in on a statewide income tax in 2010, overwhelmingly defeating a measure that would have taxed the top 1 percent of the state’s earners.

Initiative 1098 was defeated in all 39 counties, including Olympia’s Thurston County, where nearly 61 percent of voters rejected it. But of the 60 precincts within the city of Olympia — which is more liberal than the rest of the county — the measure prevailed in 38, garnering 11,380 “yes” votes to 8,925 “no” votes.

Hugh Spitzer, a University of Washington law professor specializing in state constitutional law who is affiliated with the law firm that is representing the city of Olympia in the case, said that if the state Legislature passed an income tax or asked the voters to pass a statewide income tax, there’s a reasonably good chance the court would uphold such a law this time around.

But the effort in Olympia is “beyond a code city’s statutory authority,” Spitzer said.

Heather Weiner, a spokeswoman for the initiative campaign, said the state needs to ensure that there is enough of an educated local workforce so that big companies aren’t forced to seek talent from outside of the state. As the seat of state government, Olympia is the perfect city to have that discussion, she said.

“It sends a message to the state Legislature that we need to find progressive tax solutions to our higher education crisis,” Weiner said.